Table of Contents

ToggleBuying a house is often the most exciting yet daunting adventure many will ever embark on. But before they can put up their favorite “Home Sweet Home” sign, they must tackle the infamous down payment, a ticket to the party of homeownership. So, what’s it going to take for that $400k house? Grab a seat, because this journey through dollars, percentages, and all things home financing is going to be both enlightening and, dare we say, a bit entertaining.

Understanding Down Payments

Importance of a Down Payment

Down payments are no small potatoes. They serve as a financial commitment to lenders, signaling that buyers are serious about investing in their future home. Typically, the more a buyer puts down, the less risk they pose to lenders. It’s a crucial part of the home buying equation, affecting loan terms, interest rates, and sometimes even the ability to snag that dream home.

Common Down Payment Percentages

When thinking about a $400k house, most buyers might wonder just how much cash they need up front. The discussion usually revolves around percentages. Conventional wisdom suggests a down payment of 20%, which would mean setting aside a cool $80,000. But, many buyers settle for lower down payments, ranging from 3% to 10%. Remember, the down payment doesn’t just slice the purchase price: it reduces mortgage bills and keeps monthly payments more manageable.

Factors Influencing Down Payment Amounts

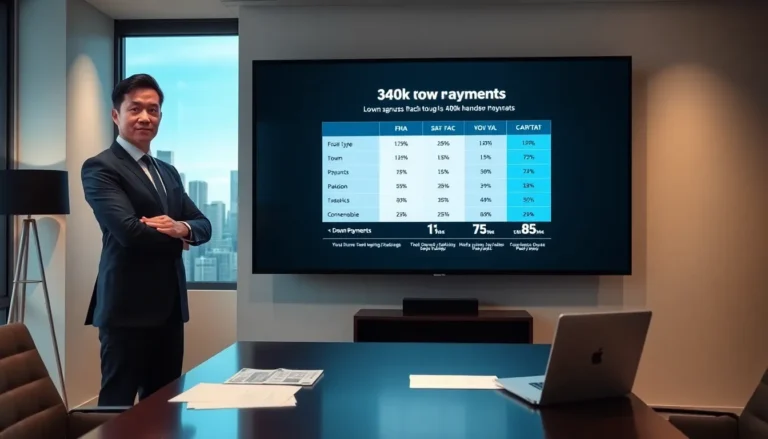

Types of Home Loans and Their Down Payment Requirements

Understanding the type of mortgage is critical because different loans come with various down payment requirements. An FHA loan might require as little as 3.5%, whereas conventional loans typically push for more. Buyers need to be informed to choose wisely.

Conventional Loans

These are the good ol’ standard loans preferred by many lenders. Conventional loans usually require a down payment of around 5% to 20%. While going with 20% can eliminate Private Mortgage Insurance (PMI), a 5% down payment can get them started on their homeownership journey, albeit with the extra hassle of PMI.

FHA Loans

These loans cater to those who may have less-than-stellar credit histories. An FHA loan offers the ability to put as little as 3.5% down. For our $400k house, that would equate to $14,000. It’s a tempting option for many first-time buyers looking to get into the market without very costly.

VA Loans

Designed for veterans, active service members, and their families, VA loans often don’t require a down payment at all. Buyers can take full advantage of this to step into a $400k home without laying any cash down at the start. But, eligibility criteria and funding fees come into play, so it’s vital for buyers to do their assignments.

Budgeting for a Down Payment

Setting a Savings Goal

Setting a savings goal is like charting a course before setting sail. Determining how much is needed for a down payment can be the first step in a successful budgeting journey. Buyers should consider their financial situation and the type of loan they’ll pursue. This will help map out how much they’ll need to save monthly.

Strategies for Saving for a Down Payment

There are multiple paths to saving that down payment. From cutting back on dining out to taking on a side gig, every little bit helps. Setting up a dedicated savings account specifically for home buying can help buyers keep their eyes on the prize. Automating transfers could make saving feel almost effortless. Also, many recommend the “no-spend challenge” for those seriously looking to save quickly. A few months without frivolous purchases can yield significant results.

Exploring Down Payment Assistance Programs

Government Programs

Various government programs exist to help buyers overcome the down payment hurdle. Many federal initiatives can boost buyers’ savings, whether it’s through tax credits or grants. Locating these resources can often mean the difference between homeownership and renting for another year.

Local and State Programs

On top of federal aid, many states offer programs that can provide substantial assistance. Some areas have unique initiatives specifically targeted at first-time homebuyers. This might include reduced interest rates, down payment assistance, or even closing cost help. Stumbling upon these options could make that $400k home more accessible.

Understanding PMI and Its Impact on Your Budget

What is PMI?

Private Mortgage Insurance, or PMI, is a bit of a necessary evil when it comes to conventional loans that require a down payment below 20%. It protects the lender in case of default. Although it can sometimes feel like a bad dream that won’t go away, understanding PMI can help buyers budget more effectively.

How PMI Affects Monthly Payments

PMI can add anywhere from $30 to $100+ to monthly payments, depending on the loan amount and how much has been paid upfront. For a $400k home, that means budgeting extra dollars each month. Buyers need to ensure they are factoring this into their overall monthly budget to avoid getting caught off guard.